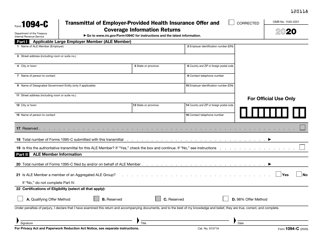

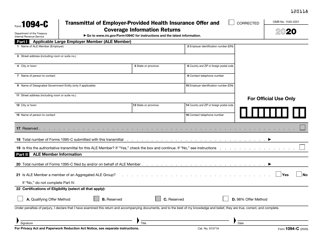

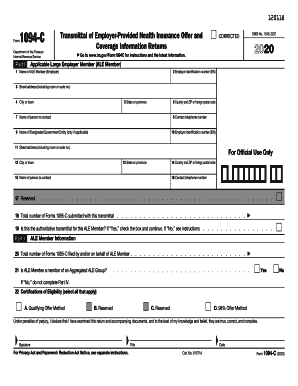

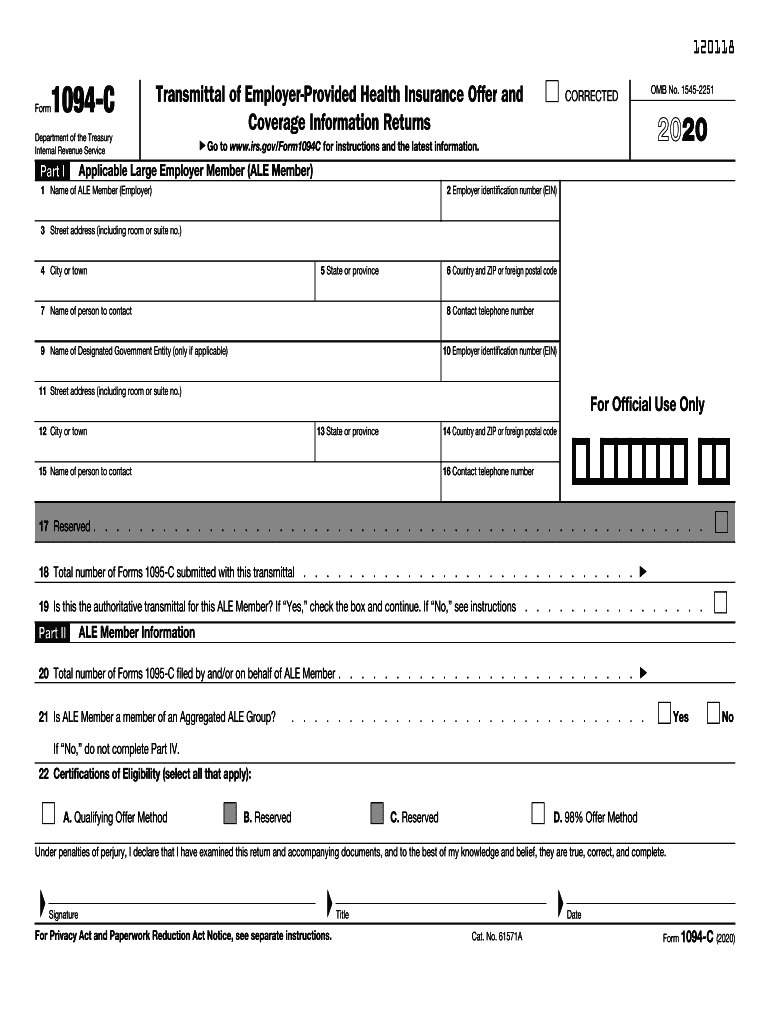

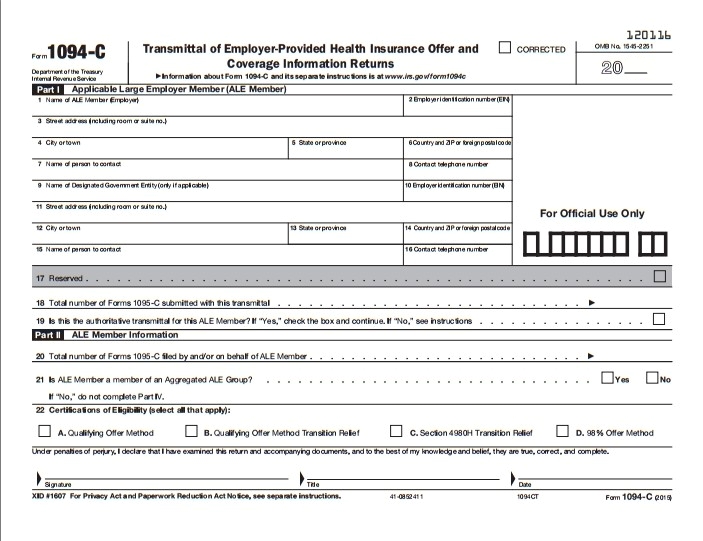

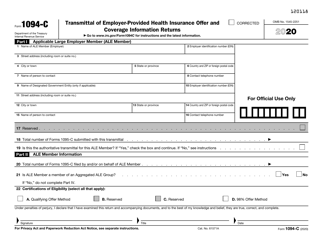

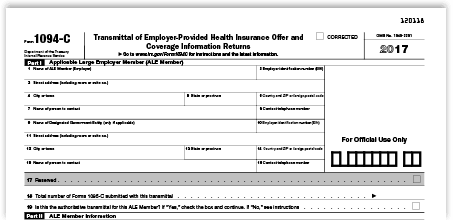

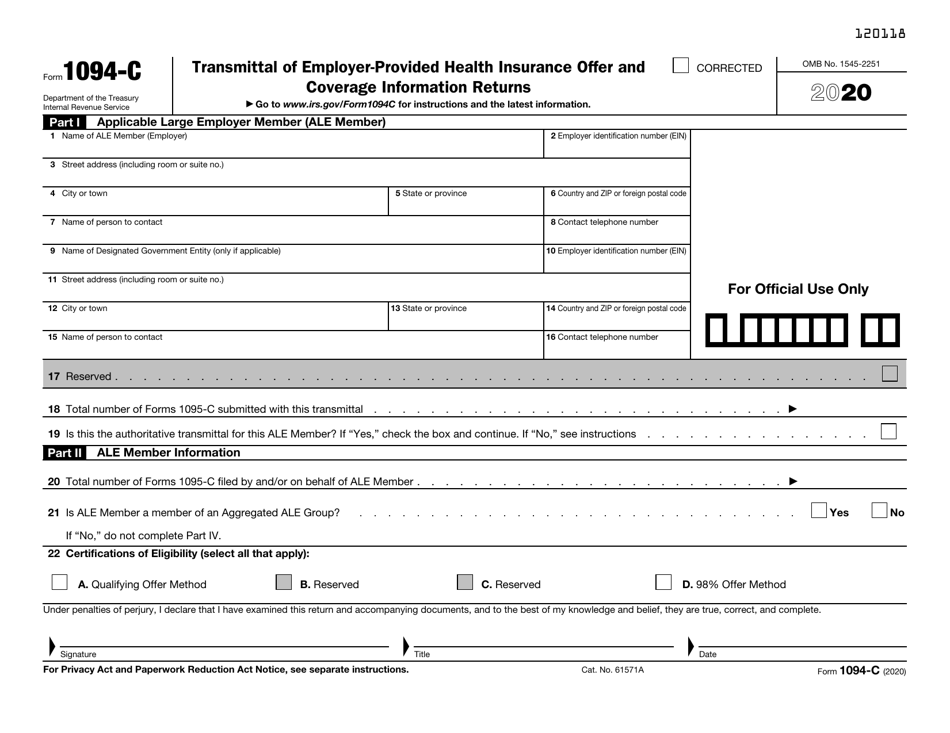

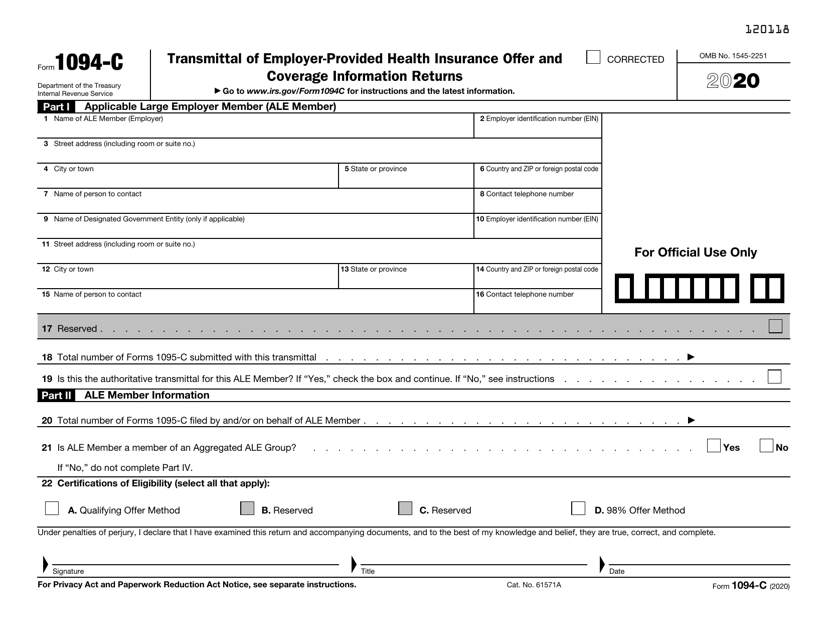

Form 1094C () 1218 Form 1094C () Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved 23;Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Return Filing is optional for CY 14, but required for Coverage Years starting in 15 All Applicable Large Employer (ALE) Members are required to file Forms 1094C and 1095C for Coverage Years starting in 16Form 1094C (16) 1217 Form 1094C (16) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e)

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Irs form 1094 c 2019

Irs form 1094 c 2019-Back to 1094C Form Guide ; This is a reminder if you are an ALE (Applicable Large Employer) you have until to generate and distribute 1095C forms to your employees and to file a 1094C form with the IRS Read more about Forms 1094C and 1095C here Forms 1094C and 1095C filing date extended to

Filing Form 1094 C Youtube

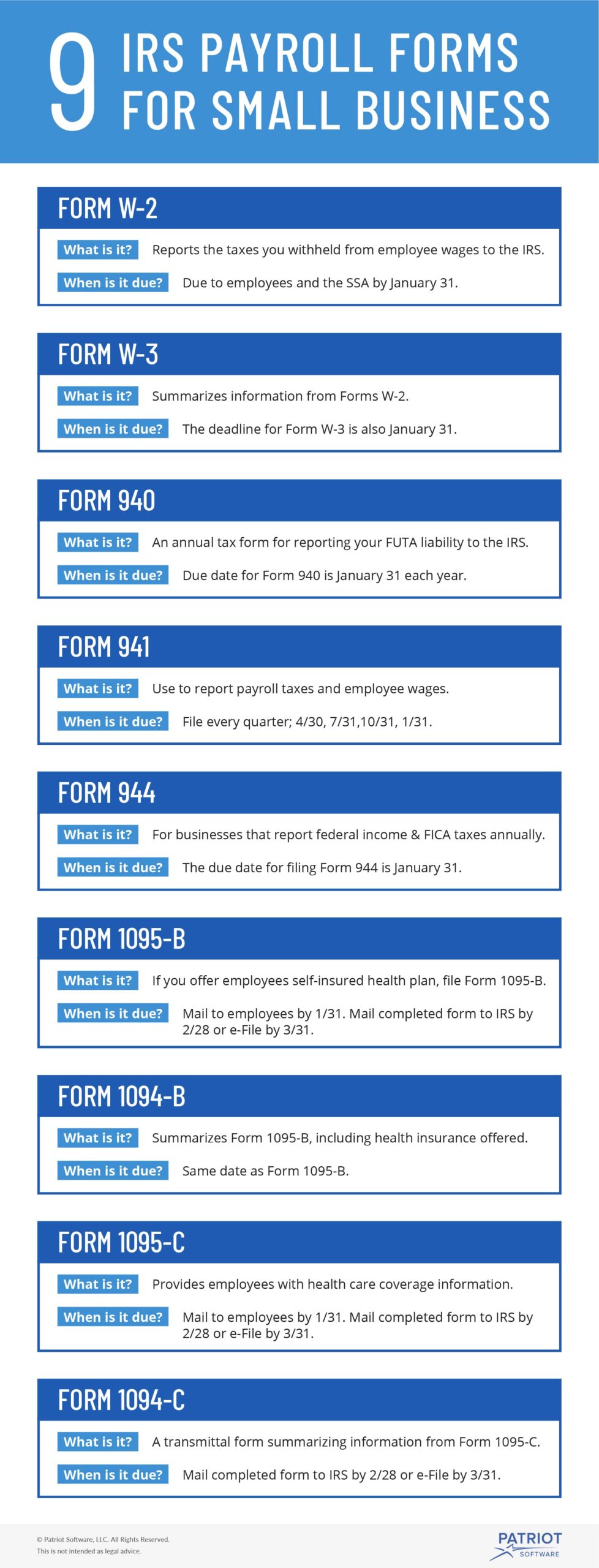

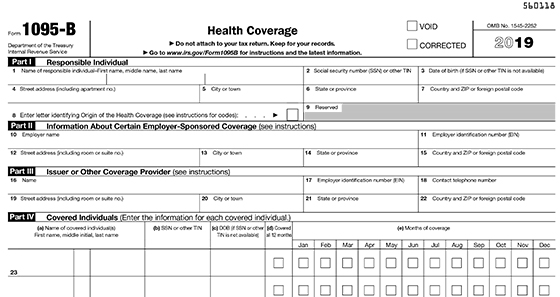

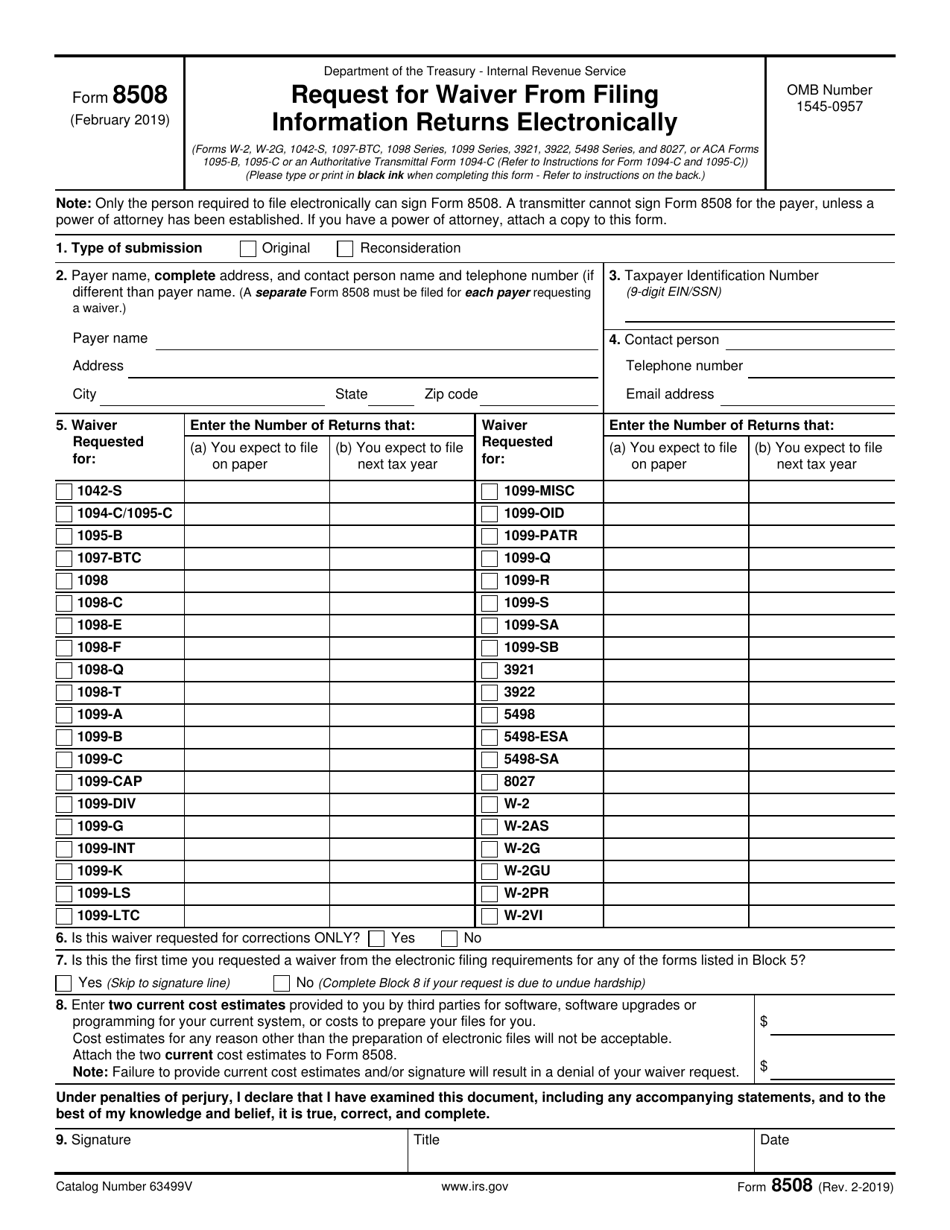

1094c deadline 1921 Complete forms electronically using PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve forms by using a legal digital signature and share them through email, fax or print them out Save forms on your PC or mobile device Boost your efficiency with effective solution!Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Note that insurers and employers in certain states (eg, New Jersey and Washington, DC) that have enacted individual mandates are required to file the 19 Forms 1094B, 1095B, 1094C or 1095C with the state and furnish the Forms to state residents

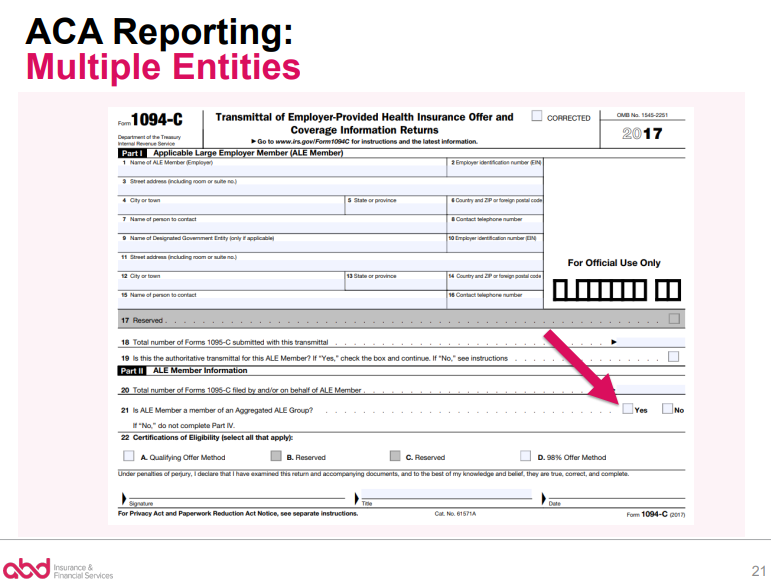

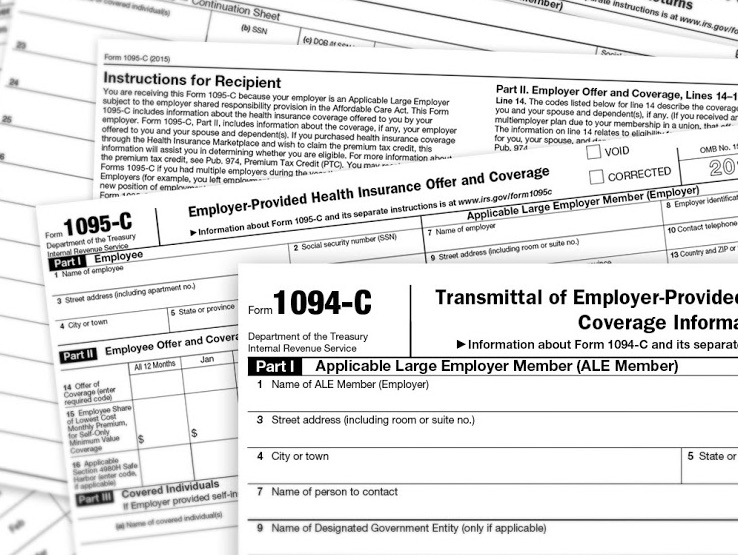

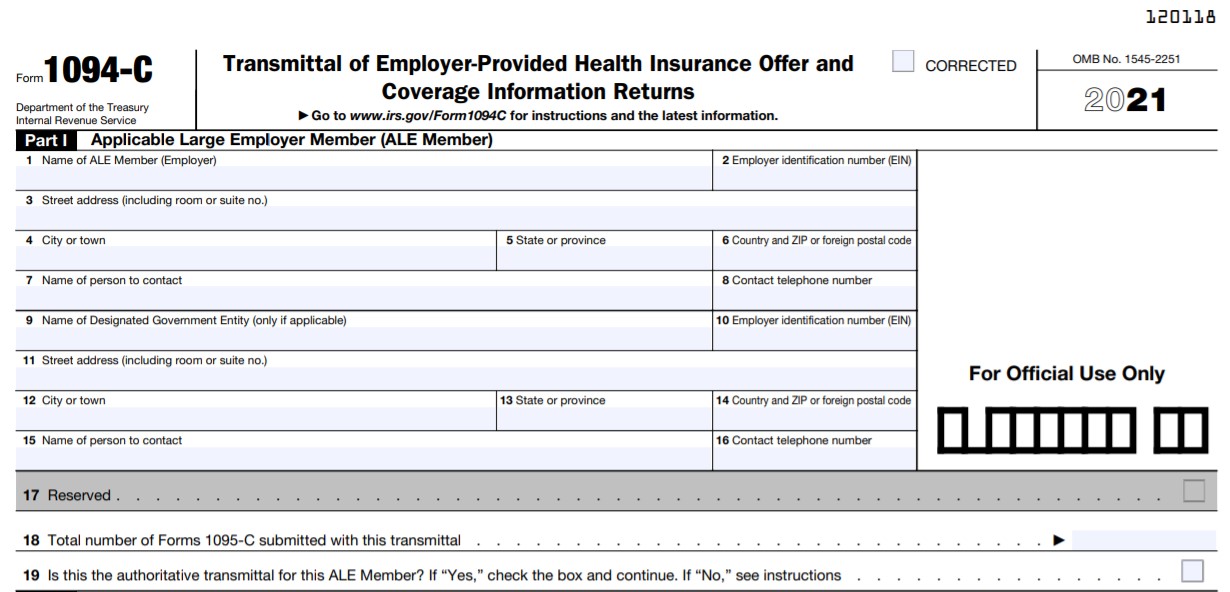

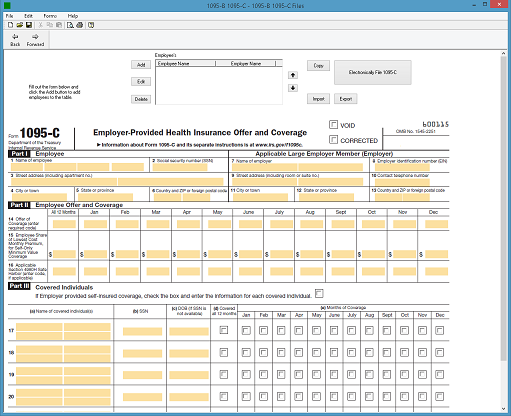

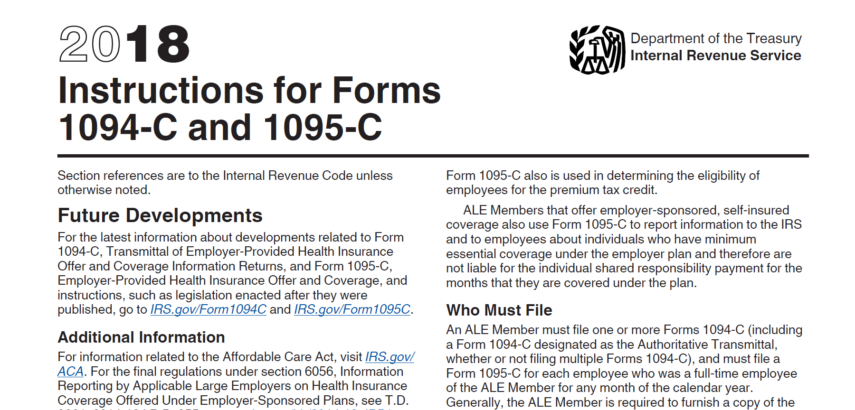

An ALE Member must file one or more Forms 1094C (including a Form 1094C designated as the Authoritative Transmittal, whether or not filing multiple Forms 1094C), and must file a Form 1095C for each employee who was a fulltime employee of62 Review and update Form 1094C before mailing or efiling forms to IRS Note IRS changed form format in Year The Form has 2 pages Year 1519 form has only one page;The other Form 1094C should not be identified as the Authoritative Transmittal on line 19, and should report on line 18 only the number of Forms 1095C that are attached to that Form 1094C, and should leave the remaining sections of the form

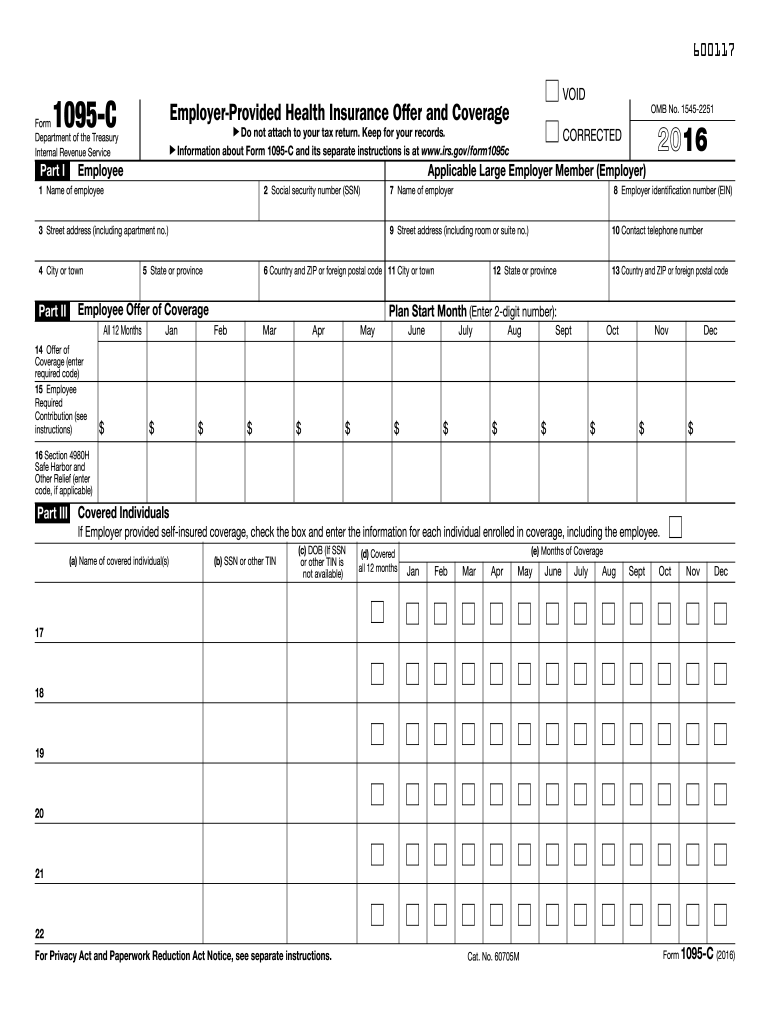

The IRS released updated instructions for the 19 filing of Form 1094C and Form 1095C The two forms remain similar to last year's versions, however, the instructions highlight the recent changes as announced in Notice 1963 Extension of due date to furnish Form 1095C 19 Form 1095C is due to employees by (instead of January The draft 19 versions of Form 1094C and 1095C are also available for download at the following links 19 Draft Form 1094C 19 Draft Form 1095C While these forms are not the final versions to be filed and furnished for the 19 tax year, they do serve as an accurate depiction of what employers should expect when preparing for 19 ACAForm 1094C Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns Inst 1094C and 1095C Instructions for Form 1097BTC 19 Form 1098 Mortgage Interest Statement (Info Copy Only) Form 1098 Mortgage Interest Statement (Info Copy Only)

The Affordable Care Act S Employer Mandate Part 4 Blog Mma

Aca Employer Mandate And Reporting Rules When Acquiring A Non Ale Newfront Insurance And Financial Services

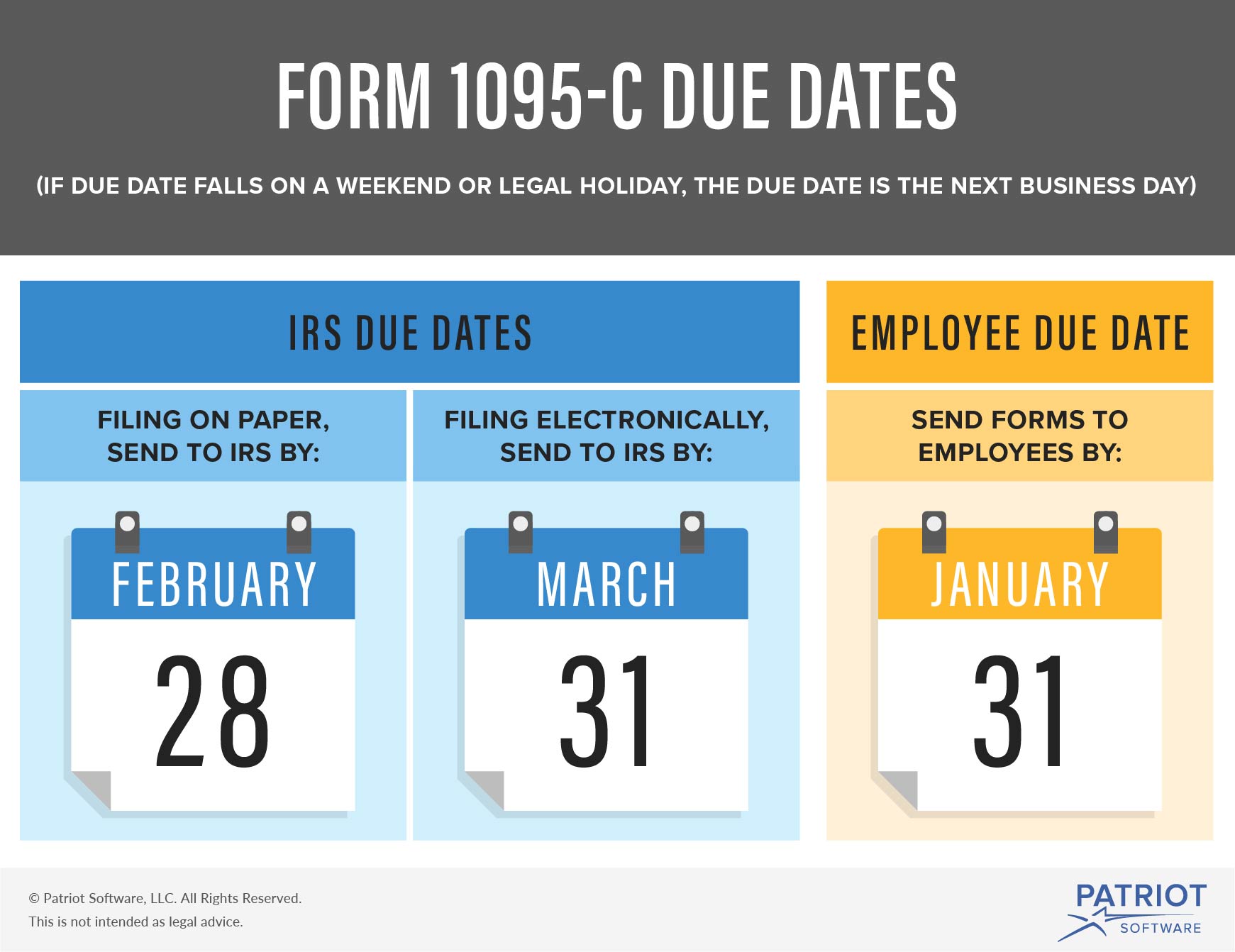

1094c 1921 Complete blanks electronically using PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents using a lawful electronic signature and share them via email, fax or print them out Save forms on your laptop or mobile device Improve your productivity with powerful solution!Form 1094C is only sent to the IRS, not to employees Form 1094C 19 Tax Year Deadlines Due to recipient January 31st, Paper file 1094C with the IRS March 2nd, Efile 1094C with the IRS March 31st, Note IRS has now extended the recipient copy deadline to from the original due date of January 31Part III ALE Member Information Monthly Line 23 to Line 25 ALE Member Information Reminder Part III (Lines 2335) should only be completed on the Authoritative Transmittal for the employer In Column (a), if you offered Minimum Essential Covertage (MEC) to at least 95% of your fulltime employees and their dependents, enter "X" in

Your 1095 C Obligations Explained

Explanation Of 2d On Line 16 Of The Irs 1095 C Form Integrity Data

1921 form 1094c Fill out blanks electronically utilizing PDF or Word format Make them reusable by making templates, include and fill out fillable fields Approve documents by using a legal electronic signature and share them by way of email, fax or print them out download blanks on your PC or mobile device Enhance your productivity with effective solution!If this Form 1094C transmittal is the Authoritative Transmittal that reports aggregate employerlevel data for the ALE Member, check the box on line 19 and complete Parts II, III, and IV, to the extent applicable Otherwise, complete the signature portion of Form 1094C and leave the remainder of Parts II, III, and IV blankUsps Form 1094 Pdf Fill out, securely sign, print or email your 1093 c 13 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

Draft 21 Aca Reporting Forms Issued By Irs The Aca Times

Your 1095 C Obligations Explained

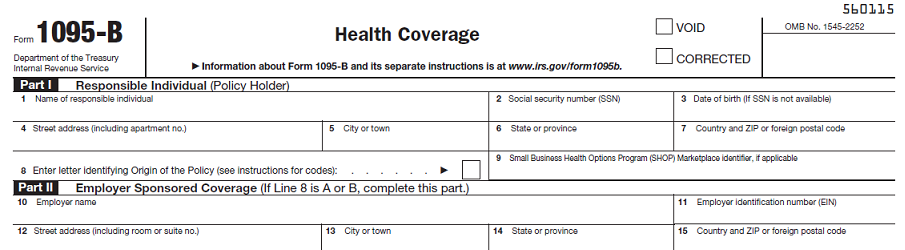

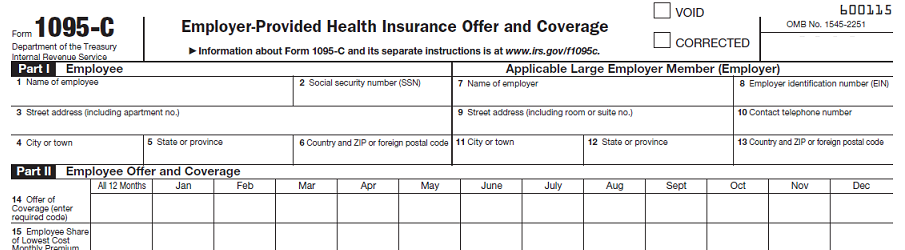

Instructions for Forms 1094C and 1095C 19 Form 1094B Transmittal of Health Coverage Information Returns 19 Inst 1094B and 1095B Instructions for Forms 1094B and 1095B 19 Inst 1066 Instructions for Form 1066, US Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnSample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19Applicable large employers with 50 or more fulltime or fulltimeequivalent employees use efileACAforms to save on the labor costs of preparing, printing, mailing and manually submitting their 1095C and 1094C forms to the IRS Smaller, selfinsured employers who must fill out the 1095B and 1094B transmittal form use efileACAforms to report the names, addresses and

Form 1094 C The Aca Times

Irs Releases Draft 19 Aca Reporting Forms And Instructions Fedeli Group

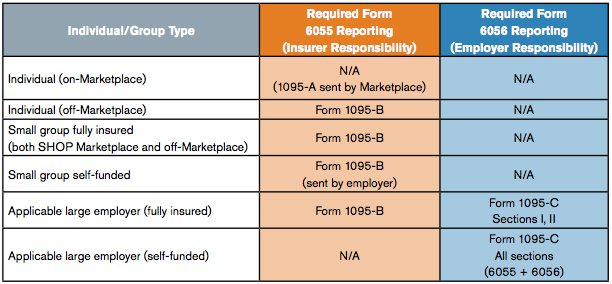

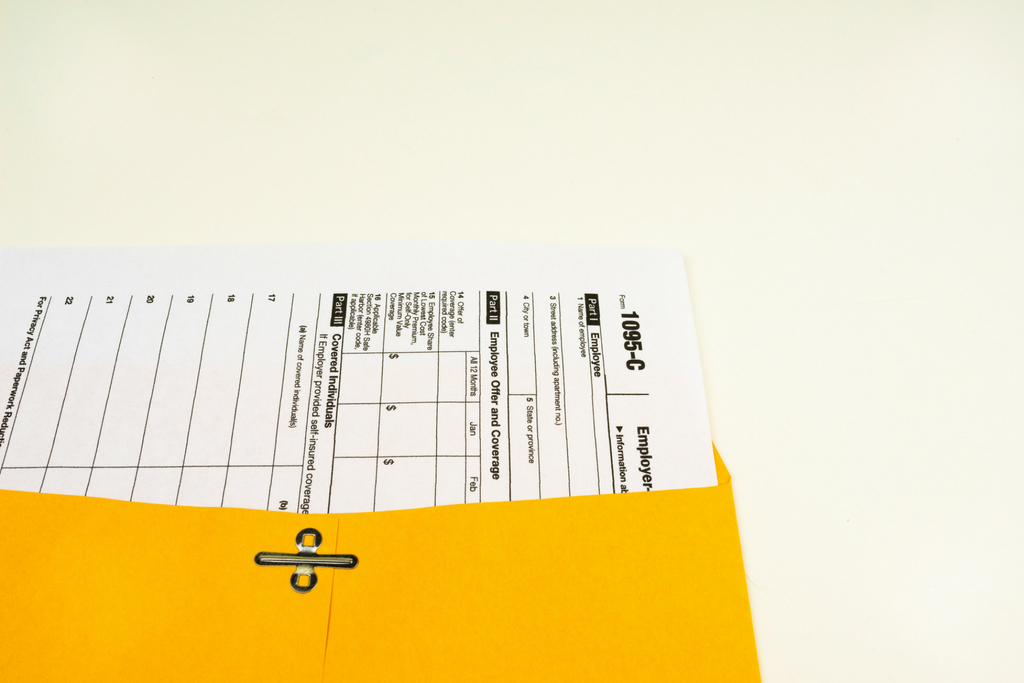

Form 1095C is furnished to individuals, but Form 1094C is not There are separate deadlines for filing forms with the IRS and furnishing statements to individuals Filing With IRS ALEs must file the 19 Form 1094C transmittal (and copies of related Forms 1095C) with the IRS by , if they are filing on paper19 ACA 1094/1095 Deadlines Chart Due Dates in 19 Action Fully Insured ALEs SelfInsured ALEs SelfInsured Employers That are not ALEs (Fewer Than 50 FullTime Employees) Provide Form 1095C to FullTime Employees January 31 January 31 Not Applicable Provide Form 1095B to Responsible Individuals (may be the primary insured, employee, Information about Form 1094C, Transmittal of EmployerProvided Health Insurance Offer and Coverage Information Returns, including recent updates, related forms, and instructions on how to file Form 1094C is the transmittal form that must be filed with the Form 1095C

Irs Finally Finalizes 19 Forms 1094 And 1095 And Related Instructions

Office Products Human Resources Forms Kudosprs Com Pack For 100 Employees 19 Includes 6 1094 B Transmittal Forms Form 1095 C Health Coverage And Envelopes With Aca Software

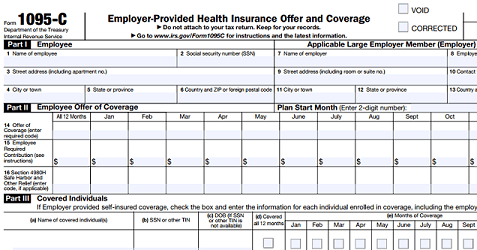

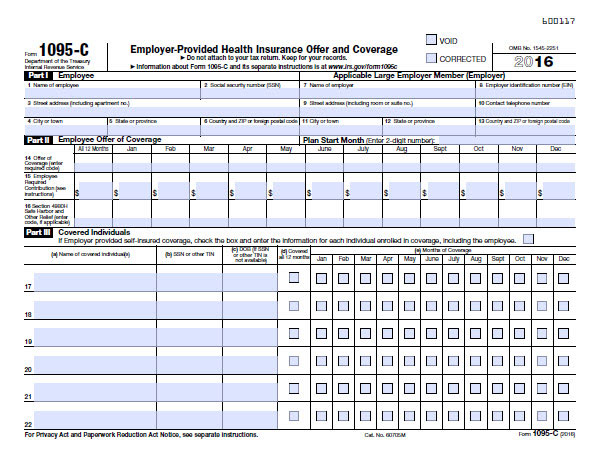

IRS Forms 1094C and 1095C are filed by employers that are required to offer health insurance coverage to their employees under the Affordable Care Act, also known as Obamacare The main difference between them is that the 1095C provides information about health insurance and is sent to both employees and the IRS, while the 1094C acts as a coverForm 1094C (19) 1218 Form 1094C (19) Page 2 Part III ALE Member Information—Monthly (a) Minimum Essential Coverage Offer Indicator Yes No (b) Section 4980H FullTime Employee Count for ALE Member (c) Total Employee Count for ALE Member (d) Aggregated Group Indicator (e) Reserved 23; 1095C information returns may file paper copies of the Forms, but paper filings must be transmitted to the IRS by IRS FORM 1094C TRANSMITTAL FORM GUIDANCE Part I Cells 18 Complete all blocks Cells 916 These are only fora government entity that is completing this form another

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

2

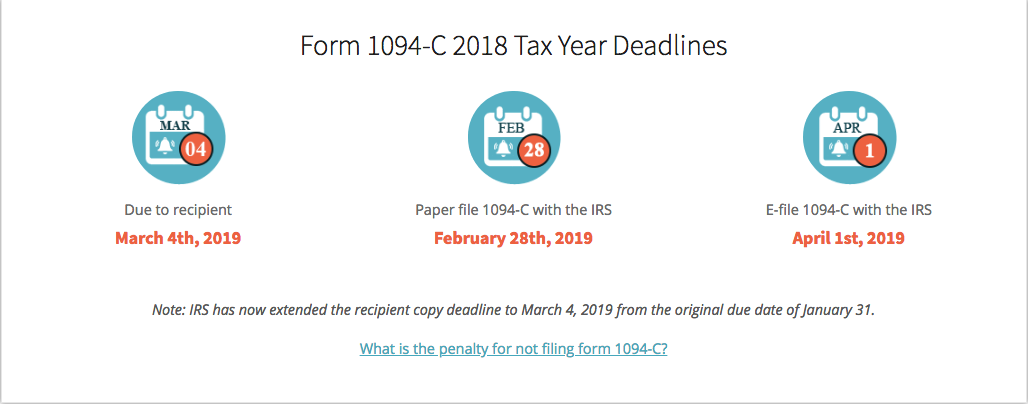

For calendar year 21 Forms 1094C and 1095C are required to be filed by or if filing electronicallyExtensionsYou can get an automatic 30day extension of time to file by completing Form 09, Application for Extension of Time To File Information ReturnsForm 1094C Filing Deadline Beginning with the 18 tax year, employers must file Form 1094C to the IRS with Form 1095C Both forms are due to the IRS by February 28 th (if paper filing) or April 01 nd (if efiling) of the year following the calendar year the return references If the regular due date falls on a Saturday, Sunday, or legal 1 minute read The IRS has released the final 1094/1095C schedules and reporting instructions for the 18 tax year, to be filed and furnished in 19 You can find the

2

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

The IRS released nal 19 Form 1094C, Form 1095C and applicable instructions Applicable large employers ( ALEs ) must furnish the Form 1095C to fulltime employees and le Forms 1094C and all 1095Cs with the IRS What s New While the Forms remain substantially the same to last year s versions, the instructions highlight recent changes asYou are receiving this Form 1095C because your employer is an Applicable Large Employer subject to the employer shared responsibility provisions in the Affordable Care Act This Form 1095C includes information about the health insurance coverage offered to you by your employer Form 1095C, Part18 Form 1095C (employee statement) Due 18 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) If the due date falls on a weekend or legal holiday, the

Form 1095 A 1095 B 1095 C And Instructions

State Individual Mandates Add To Employer Reporting Responsibilities Foster Foster

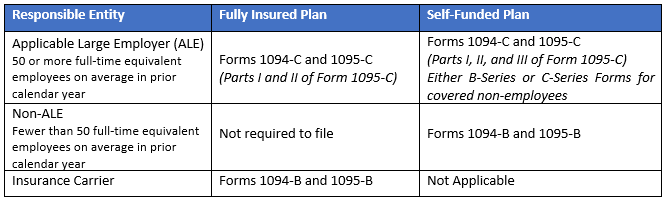

1094C and all 1095Cs with the IRS3 WHAT'S NEW While the Forms remain substantially the same to last year's versions, the instructions highlight recent changes as announced in Notice 1963 Extension of due date to furnish Form 1095C 19 Form 1095C is due to employees by (instead of ) Check out the recently released Form 1095C for the 19 tax year here In addition to filing a 1095C, employers are also required to file a 1094C, which is basically just the cover sheet for all of an organization's 1095C forms (you must file one 1094C per tax ID) Unlike 1095Cs which are distributed to employees, 1094Cs are solely The reporting stipulation states that an information return will be prepared for each applicable employee, and these returns must be filed with the IRS using a single transmittal form (Form 1094B & 1095B or Form 1094C & 1095C) The filing requirements are based on an employer's health plan and the number of employees

Irs Issuing 1094 C 1095 C Penalties Essential Staffcare

Irs E Filing Deadline March 31 22 Aca Gps

Employers are responsible for furnishing their employees with a Form 1095C by Thursday, Employers are still responsible for filing copies of Form 1095C with the IRS by Thursday, , if filing by paper or Monday, , if The IRS has released final Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year No material changes have been made to the forms, either from prior years or from the drafts released in November (see our Checkpoint article) (The "Instructions for Recipient" included with Form 1095B and 1095C have beenForm 1098C Contributions of Motor Vehicles, Boats, and Airplanes (Info Copy Only) 19 Inst 1098 Instructions for Form 1098, Mortgage Interest Statement Instructions for Forms 1094C and 1095C

Procedures To Print The 1094 C And Mail The 1094 C And 1095 C S To The Irs Integrity Data

2

If a substitute form is used, this form must meet all the content requirements of the IRS and should include every piece of information needed for Form 1094C and Form 1095C In 17, the IRS provided draft instructions for forms 1094, 1095, and other forms required for ACA reporting1095c due date 1921 Complete forms electronically working with PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve documents by using a lawful electronic signature and share them via email, fax or print them out download documents on your personal computer or mobile device Boost your efficiency with effective Form 1094C (19) DO NOT FILE DRAFT AS OF 1316 Form 1094C (19) Page 3 Part IV Other ALE Members of Aggregated ALE Group Enter the names and EINs of Other ALE Members of the Aggregated ALE Group (who were members at any time during the calendar year)

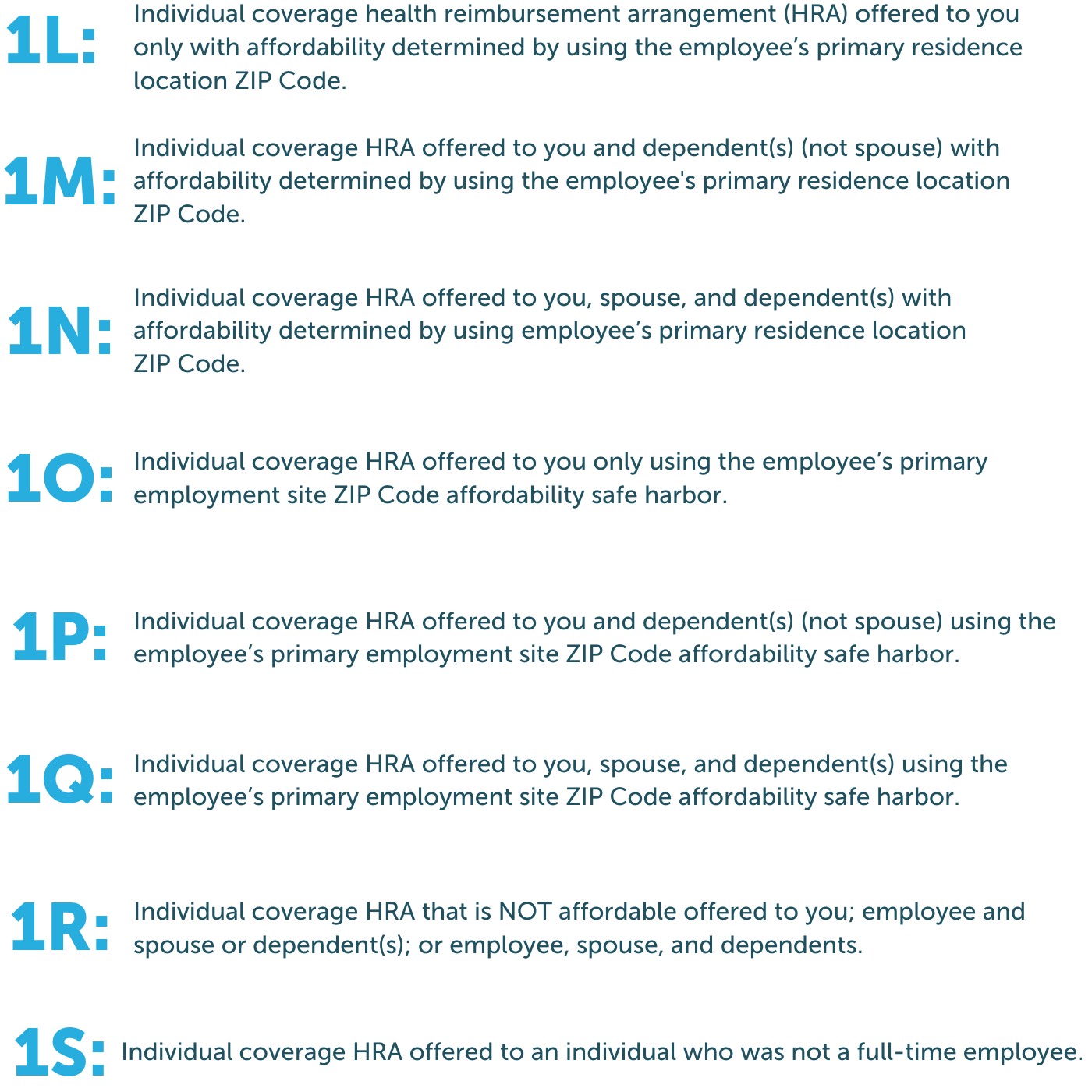

Irs Releases Forms 1094 1095 And Related Instructions Including New Rules For Ichra Reporting

What You Need To Know About Aca Annual Reporting Aps Payroll

19 Employer Reporting a 1094C and 1095C Refresher Draft 19 Forms and Instructions for Forms 1094C and 1095C have been released by the IRS, and we anticipate seeing final forms shortly Although 19 marked the end of the individual health coverage mandate penalties, very few changes have been proposed to the employer ACA reporting requirements The IRS has released draft Forms 1094/1095B (B Forms) and Forms 1094/1095C (C Forms), and related instructions, for the 19 tax year As a reminder, the B Forms are filed by minimum essential coverage providers (mostly insurers and governmentsponsored programs, but also some selfinsuring employers and others) to report coverage information in accordance withDraft Tax Forms Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing

Upcoming Key Compliance Deadlines And Reminders For First Quarter Lockton Companies

Office Products Human Resources Forms Ghdonat Com Includes 6 1094 B Transmittal Forms Pack For 100 Employees 19 Form 1095 C Health Coverage And Envelopes With Aca Software

Fill Online, Printable, Fillable, Blank F1094c 19 Form 1094C Form Use Fill to complete blank online IRS pdf forms for free Once completed you can sign your fillable form or send for signing All forms are printable and downloadable F1094c 19 Form 1094C On average this form takes 35 minutes to completeACA 1094/1095 Reporting Requirements for 19 NOTE This guidance does not provide complete details for groups of 250 or more employees Guide for brokers Sample Form 1095B Form 1094C and Form 1094C Instructions Sample Form 1095C 9495 eport equir 29 6 Guidance for Applicable Large Employers

Irs 1094 C Form Pdffiller

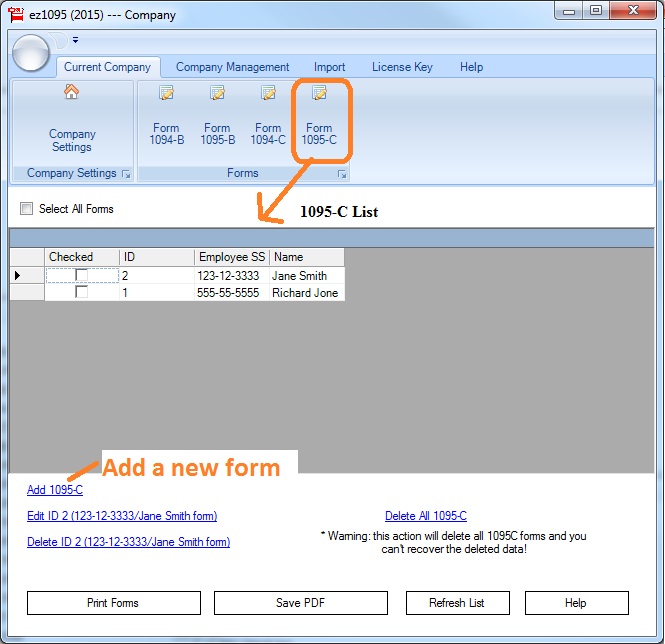

Ez1095 Software How To Print Form 1095 C And 1094 C

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Irs 1095 C Form Pdffiller

1095 C Reporting How To Use Affordability Safe Harbors For Integrity Data

16 Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Guide To Prepare Irs Aca Form 1094 C Form 1094 C Step By Step Instructions

Corpsyn Com

1094 B 1095 B Software 599 1095 B Software

Fill Free Fillable F1094c 19 Form 1094 C Pdf Form

1

Yes Employers Still Need To File Forms 1094 And 1095 Word On Benefits

Irs Releases 1094 C 1095 C Forms For 19 Tax Year

Filing Form 1094 C Youtube

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Form Irs 1094 C Fill Online Printable Fillable Blank Pdffiller

Irs Form 1095 C Codes Explained Integrity Data

1094 C Form Transmittal Discount Tax Forms

Newest Ez1095 Aca Software Is Easy And Fast With Latest Import Feature In The 19 Version

Upcoming Key Compliance Deadlines And Reminders For Second Quarter Lockton Companies

Visionaryrentals Com Pack For 100 Employees 19 Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Human Resources Forms Office Products

Aca Compliance Filing Deadlines For The 18 Tax Year

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

1094 C 1095 C Software 599 1095 C Software

trix Irs Forms 1094 C

New Form 1095 C Draft Issued By Irs For Filing In 22 Bernieportal

Aca Reporting Generate Review Your 1094c 1095c Data And Forms

Irs Issues Draft Form 1095 C For Aca Reporting In 21

A Z Important Terms To Know For Forms 1094 1095 C Ts1099 Ts1099

Irs Announces Limited Relief For Information Reporting On Forms 1094 1095

Form 1094 C Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns All Pages B1094cs05 21 41 25

Irs Form 1094 C Form 1094 C Online 1095 C Transmittal Form

Control Files And Sample Forms

Your 1095 C Obligations Explained

Employer Reporting Of Health Coverage Presented By Carly

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Control Tables And Sample Forms

Form 1095 C Guide For Employees Contact Us

Visionaryrentals Com Pack For 100 Employees 19 Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Human Resources Forms Office Products

Compliance Update Forms 1094 C And 1095 C Calcpa Health Trusted Health Plans For Cpas

1095 1094 Aca Forms Ez1095 18 Offers A Correction Form For Customer Convenience

Streamlined Aca Reporting Methods Newfront Insurance And Financial Services

Form 1095 A 1095 B 1095 C And Instructions

Benefit Advisors Network

Office Products Human Resources Forms Kudosprs Com Pack For 100 Employees 19 Includes 6 1094 B Transmittal Forms Form 1095 C Health Coverage And Envelopes With Aca Software

What You Need To Know About 1094 Forms Blog Taxbandits

1

1

Office Products Human Resources Forms Kudosprs Com Pack For 100 Employees 19 Includes 6 1094 B Transmittal Forms Form 1095 C Health Coverage And Envelopes With Aca Software

Three Things To Know About 1095 Cs In 19

Fill Free Fillable F1094c 19 Form 1094 C Pdf Form

:max_bytes(150000):strip_icc()/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Ez1095 Software How To Print Form 1095 C And 1094 C

Visionaryrentals Com Pack For 100 Employees 19 Form 1095 C Health Coverage And Envelopes With Aca Software Includes 6 1094 B Transmittal Forms Human Resources Forms Office Products

1095 1094 Aca Forms Ez1095 19 From Halfpricesoft Com Just Released Efile Version

2

Ez1095 Software How To Print Form 1095 C And 1094 C

How To Print Aca 1095 C And 1094 C Form Youtube

2

Upcoming Key Compliance Deadlines And Reminders For First Quarter Lockton Companies

Irs Releases Instructions And Draft Form 1094 C And 1095 C Basic

1094 C 1095 C Software 599 1095 C Software

The Irs Wants To Know Has Your Company Filed Form 1095 C

Irs Form 1095 C Codes Explained Integrity Data

Code Series 2 For Form 1095 C Line 16

9 Irs Payroll Forms For Small Businesses To Know About

Common Mistakes In Completing Forms 1094 C And 1095 C

How Does A Layoff Affect Form 1094 1095 Information Reporting For Full Time Employees Under The Lookback Measurement Method

E File Aca Form 1095 C Online How To File 1095 C For

Irs Form 1094 C Download Fillable Pdf Or Fill Online Transmittal Of Employer Provided Health Insurance Offer And Coverage Information Returns Templateroller

Aca Complyright 19 Aca Tax Software Use For Forms 1095 B And 1095 C And 1094 B And 1094 C Tax Forms Office Products

How To Print Aca 1095 C And 1094 C Form Youtube

L1094 C Transmittal Form Page 1 Only

2

Health Welfare Foster Foster

3

Irs Form 8508 Download Fillable Pdf Or Fill Online Request For Waiver From Filing Information Returns Electronically Templateroller

Your Complete Guide To Aca Forms 1094 C And 1095 C

Employer Deadline To Furnish Forms 1095 B C To Employees Extended To March 2 Sequoia

2

0 件のコメント:

コメントを投稿